Need a Payoneer alternative for sending or receiving payments? There is a better alternative to Payoneer. Find out in this article.

If you’ve been caught up in the whole Wire Card fiasco and your Payoneer funds are held up, there is really nothing you can do until the situation returns to normal.

As far as I understand, your Payoneer funds are intact and will be available as soon as the FCA (Financial Conduct Authority, which is UK’s financial regulatory body) completes an audit of Wire Card UK.

With that said, online businesses always come with some risks. Whether it’s Google updates, PayPal freezing accounts, Shopify banning stores, etc.

In this case, Payoneer is the one on the receiving end for freezing accounts, especially at these hard times of Covid-19.

However, as we wait for things to normalize, it would be a good idea to look for other payment alternatives, just to be safe. You really don’t want to have all your eggs in one basket.

I’ve been using a secure Payoneer alternative for some of my online businesses. In particular, I use the Payoneer alternative to receive my UK Amazon earnings.

The service I use is called TransferWise.

In this guide, I’ll take you through what TransferWise is, how you can sign up, and how you can link it to your Amazon account to withdraw funds.

Therefore, if Payoneer has been a pain to use for you, you’ll want to sign up with TransferWise.

Let’s get started with this TransferWise review.

Payoneer Alternative: Introducing TransferWise

TransferWise is one of the biggest online money transfer services in the world. The service was founded in UK in 2010 on the premise that consumers deserved fair exchange rates when converting or transferring money from one currency to another.

TransferWise eliminates the markups that traditional banks charge on currency exchange rates. With the service, you get your money for the real prevailing exchange rate.

According to data from TransferWise, there are over 4 million customers using the service globally.

Transferwise Services

Tranferwise offers three core services that you can take advantage of if you do any kind of online transactions:

- Sending money and exchanging currencies for a low and transparent fee

- A free borderless account, which you can hold over 50 different currencies. This is perfect for Amazon affiliates, sellers, and e-commerce business owners.

- A Transferwise debit Mastercard, which you can use to make payments worldwide

You can use each of the services individually, except for the TransferWise debit card, which is connected to your borderless account.

I signed up with TransferWise in 2018 but only started using it in early 2019.

Initially, I used the service for currency exchange. However, later on, I opened the free borderless account and ordered the TransferWise debit card to use for withdrawing money at my local ATMs.

Over the time that I’ve been using TransferWise, there are a few things I’ve come to learn. In this article, I’ll touch on the features of TransferWise, share the advantages as well as the downsides of the service.

First off, why should you use TransferWise?

Why Use TransferWise

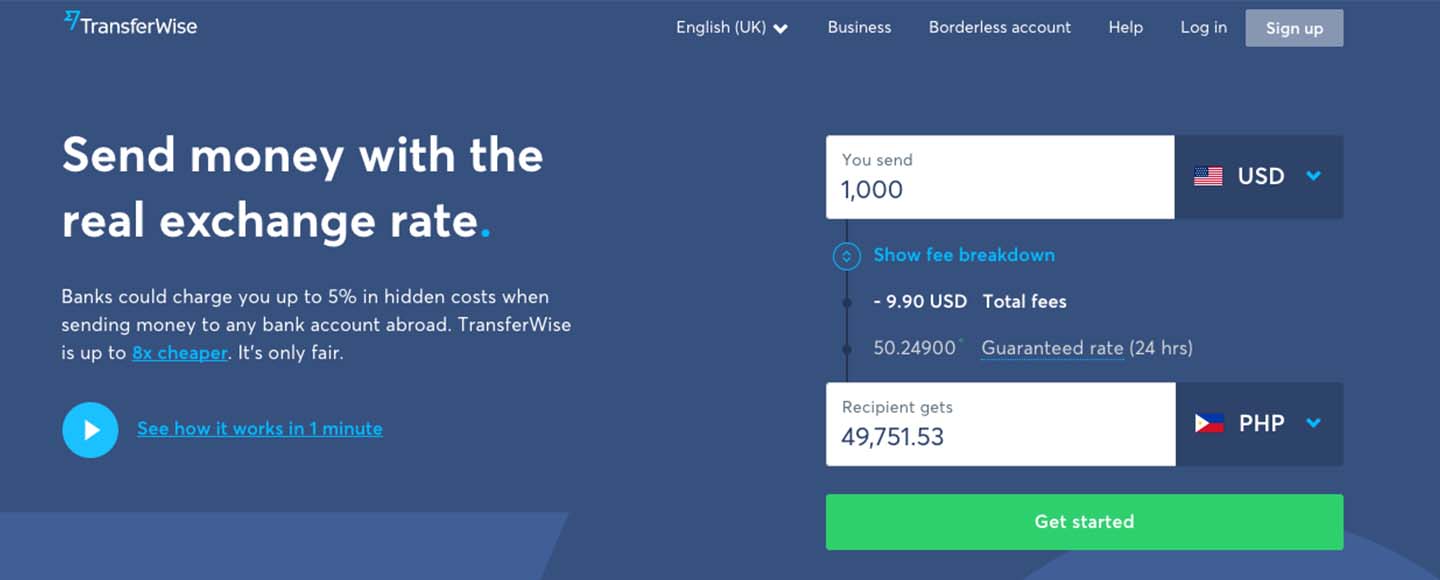

TransferWise offers a cheap and easy way of transferring money in different currencies.

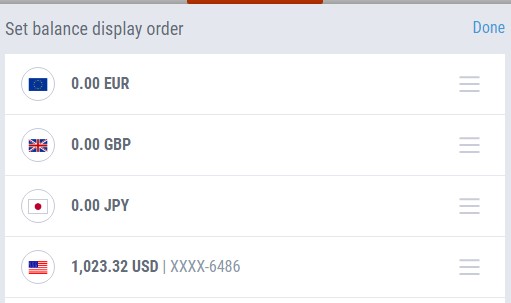

I know Payoneer also offers different currencies under the same account. In my case, my account was approved for 5 international currencies.

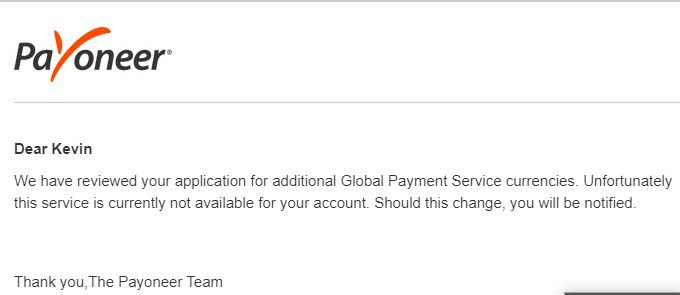

Moreover, if you wanted to get additional currencies, you had to apply. I had my application for an AUD account denied by Payoneer several times.

When I signed up with TransferWise, the issue was solved. The service offers more than 50 international currencies under your account, without the need for you to apply.

Check the currencies supported below:

TransferWise makes it easy and convenient to convert money to different currencies and send money abroad without the need for a special bank account.

Therefore, whether you are a company looking to pay your overseas contractors or simply need to send money to anyone outside of your country, Transferwise is for you. The person will receive money in their local currency. Currently, you can manage 50 currencies in your account.

Of course, TransferWise charges some fees for its services. However, the fees are up to 8 times lower compared to what you would pay with a traditional bank. Moreover, while a traditional bank may take 5 to 8 business days to deliver the money, Transferwise delivers the money almost instantly.

And when we compare it to Payoneer, TransferWise still wins with lower transaction charges.

Here is a side-by-side comparison of the fees charged by both TransferWise and Payoneer for various transactions:

| Description | TransferWise Fees | Payoneer Fees |

|---|---|---|

| Monthly Fees | 0 | $3 |

| Annual Fees | 0 | $30 |

| Withdrawing Cash from ATM Using Card | Free up to £200 every 30 days. | 3.5% for the total value |

| Receiving money in USD | 0 | 0% -1% |

| Sending money | 0 | 1% – 3% |

TransferWise Review: Overview of the Service

TransferWise is an electronic money exchange and transfer service that was founded in UK in 2010.

The company is regulated by the FCA (Financial Conduct Authority), which is UK’s money regulatory authority. In the US, TransferWise is registered with the Financial Crimes Enforcement Network and follows the regulations of authorities in each state.

Therefore, TransferWise is not just another fly-by-night company registered in the Caymans by anonymous owners. Rather, it is a legitimate company that is regulated by financial authorities in both the US and UK.

Just like Payoneer, TransferWise is not a bank. Instead, the company works with various partner banks. When you deposit money in your borderless account, the money is held by one of the partner banks.

A little bit more about the partner banks:

- Your USD account is opened with Wells Fargo, Cross River Bank, or Federal Saving Bank. Moreover, your balance is insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. Therefore, in case of any issues, you will always get your money back.

- Your EUR account is opened with the German Handelsbank and the European Deposit Guarantee Scheme insures your balance up to €100.000.

TransferWise Fees

The fees you are charged depend on the service that you need. However, the fees are quite cheap, compared to those charged by Payoneer and other online money services.

There are three factors that determine the fees charged: amount, payment method and currency conversion fee.

Amount

The fees here are calculated as a percentage of the amount you are sending as well as the currency. There is a minimum fee for a small amount.

You can see all the account fees here.

Payment Method

You can choose to transfer money from your debit card, credit card, or bank account. The fees also vary depending on the payment method.

You will know how much you will be charged when you set up your transfer.

Once I started using TransferWise, I got hooked. I’m sure you will also love it.

Currency Conversion Fee

A currency conversion fee is charged for every transaction between currencies, e.g., when you have a USD account and are purchasing something in EUR or paying someone in a different currency.

The fee varies between 0.35% and 2.85%, depending on the currency. TransferWise has a handy calculator that you can use to see the currency conversion fee.

The best way to know how much you will pay is to go to TransferWise homepage and enter the currency pair. You will then see the conversion rate as well as the applicable fees.

NSV Readers' Exclusive: Transfer Up to $500 FREE

Sign up for TransferWise and Get Your First $500 Transfer Without Any FeesBorderless Account

Payoneer charges a monthly fee of $3 and an annual fee of $30 for account maintenance. However, Transferwise does not have any monthly or annual fees.

TransferWise Debit Card

For the TransferWise debit card, the fees are related to the currency exchange as well as ATM withdrawal. Unlike Payoneer that charges a fee for ordering a new card and shipping, Transferwise has no charges for ordering or shipping their card.

Here are the fees related to TransferWise card:

- The conversion fee is typically between 0.35% and 1% for currencies that you don’t hold in your account.

- ATM withdrawals of up to £200/$250 a month are free

- For ATM cash withdrawals of above £200/$250, you are charged a 2% fee or currency’s equivalent per month.

NOTE: Depending on the country where you are, there may be additional fees charged by the ATM provider. Also, it is best to withdraw the money in your local currency to avoid inflated currency exchange rates charged by the ATM provider.

Finally, keep in mind that the fees may be revised from time to time. Therefore, you should check TransferWise’s Price Checker for the latest accurate fees.

How to Open a Transferwise Borderless Account

The TransferWise borderless account is available in most countries.

To sign up, go here.

Signing up for the account is free. There is no time-consuming verification process or credit check. You do not even need to deposit a balance to your account for it to become active.

To open an account, you only need an email address and fill in your details. You’ll also have to upload a copy of your ID.

Finally, there is no monthly or annual fee charged for account maintenance.

You can open an account with multiple currencies, including USD, GBP, EUR, NZD, AUD, among others. I particularly signed up TransferWise to be able to withdraw my GBP earnings from Amazon UK.

Opening a TransferWise Account

If you do not have a TransferWise account, click here to open one for free.

On the link, you will have to provide the usual personal information:

Sending Money Using Transferwise

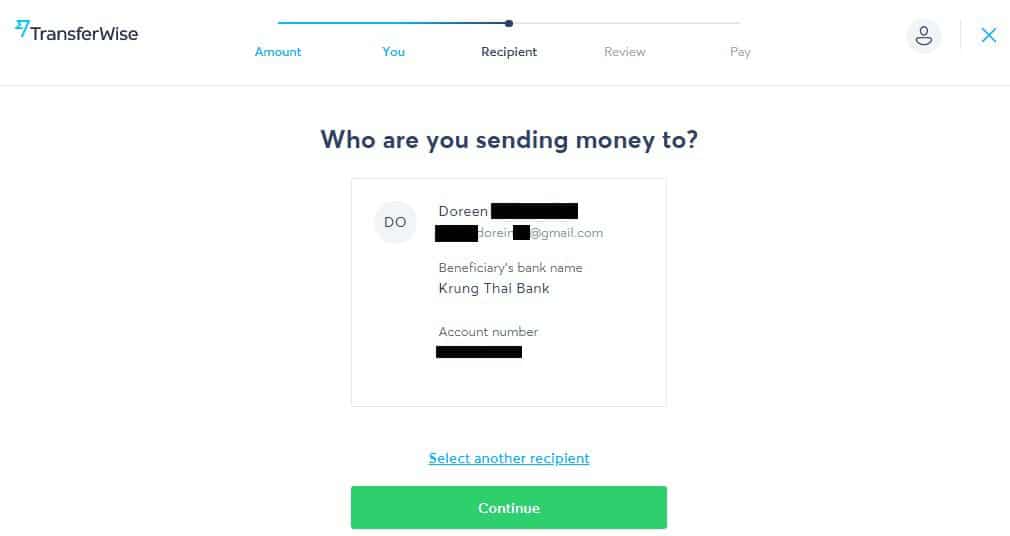

TransferWise makes it easy for anyone to send or receive money. The recipient does not need a TransferWise account to receive money.

Even if you do not have the borderless account, you can still send money in any of the supported currency pairs.

You can also transfer money between TransferWise accounts of the same currency, as long as your borderless account has some balance.

NSV Readers' Exclusive: Transfer Up to $500 FREE

Sign up for TransferWise and Get Your First $500 Transfer Without Any FeesWhen you log into your TransferWise account, go to Transfer Type and choose low cost, fast, or advanced options.

To make a transfer, you need a free TransferWise account. You don’t need the borderless account for this.

TIP: If you have some balance in your TransferWise account, you can transfer it to your recipient. This option is cheaper than transferring money directly from your credit card or bank account.

To transfer funds from your balance, choose Transfer Type > Balance Transfer and follow the instructions.

You will then have to enter the bank details of the recipient.

Note: If you did not provide your ID during the registration process, you will have to upload it before the transaction is effected. The ID is required to verify your identity.

After your ID has been verified, you will have to review the transfer details as well as choose a payment method. I recommend that you deposit some balance in your account and transfer it to your recipient. This is much cheaper than transferring directly from your debit or credit cards, as no additional fees as added to your transfer.

You can see the fees associated with debit or credit card transfers here.

When you send money for the first time, your recipient will receive it within 6 days for the first time.

However, after the first transaction, other transactions are settled in hours.

For example, sending $1000 to a recipient’s account in Kenya happens instantly. However, in Brazil, it takes 8 hours. For most countries, sending money happens almost instantly.

TransferWise Debit Card

The TransferWise debit card is a Mastercard that is similar to the Payoneer card you may know.

With this card, you can withdraw funds in your account from any ATM across the world. You can choose to get your money in a supported currency or your local currency.

You can order the TransferWise debit card from your account or through TransferWise app. The card is issued for FREE.

Here are some highlights of the card:

- No transaction fees when you pay for goods or services with currencies in your account.

- Free ATM withdrawal up to £200/$250 per month (Local ATM fees may apply)

- Low currency conversion fee of between 0.35% and 1%

- Money conversion at the prevailing exchange rate

Comparing TransferWise and Payoneer cards, it is clear that the former is much cheaper. You won’t also find a card offered by a traditional bank that has lower fees than TransferWise.

TransferWise Conversion Rate – What You Should Know

I went with TransferWise because it’s been in operations for a long time and has low currency exchange fees. The company uses real-time exchange rates (mid-market rate), which you can confirm from Google.

However, the service’s conversion fee varies depending on the currency you want to transfer. The conversion fee ranges from 0.35% to 2.85%.

The minimum fee is about £0.65. You can check the current rate on the TransferWise app or website before sending money.

Since I get paid from Amazon UK in GBP, I wanted a service that will not eat into my earnings through high conversion fees. TransferWise is just perfect.

How the TransferWise App Works

TransferWise comes with a handy app that you can use to track your account activity and carry out transactions.

You can sign into the app with your fingerprint. There’s also an option of setting up your account with two-factor authentication (2FA) for even more security.

However, the TransferWise app does not support all the features you can use from the browser app. Therefore, I recommend first signing up for TransferWise through your browser and then downloading the app to track your activities.

If you are looking for a Payoneer alternative, I highly recommend TransferWise. The service is not only cheaper, but also convenient to use, supports more than 50 currencies, and most payments are settled in hours rather than days.

Thanks for the Post on Transferwise its way bettter than Payoneer or Paypal and the exchange rate to KSH is amazing minus the fees.

Question how did you get the Debit Card for me it always shows Not available in my Country. Im also in Kenya